The Generational Opportunity from Today’s New Energy Paradigm

A new paradigm has gripped the global energy markets… and it’s creating the most attractive investment opportunity of a generation.

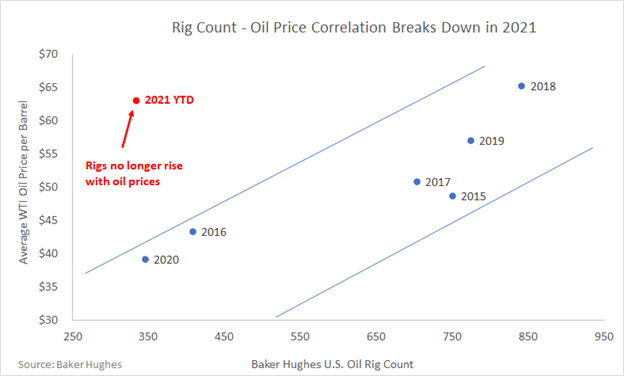

In the past, capital chased economic opportunity in the energy markets. We see this reflected in the historical relationship between prices and rig counts. As you would expect, periods of high oil prices would draw capital into the market, sending rig counts higher. Inevitably, the excess capital would create excess supply, pushing prices and rig counts back down. Thus oil normally follows the same boom/bust cycle seen across most other commodities.

But 2021 ain’t your normal oil market.

The previous relationship between oil prices and rig deployments has officially broken down:

Looking at today’s rig count, you’d think oil was trading at 2016 or 2020 levels. Instead, despite the oil and gas trading a multi-year highs, capital remains stubbornly sidelined in the current market. In other words…

Capital allocators now avoid oil and gas at all costs, regardless of the returns available.

In today’s article, I’ll explain what’s driving this seemingly irrational behavior, and why it’s creating the best investment opportunity we’ve seen in over a decade.

Shale Shocked: Investors Recovering from a Decade of Capital Destruction

The capital exodus from energy markets makes sense in the context of recent history. The shale revolution invited record volumes of capital into oil and gas development over the last decade. This excess capital forced up land, lease and drilling costs, and then ultimately oversupplied the market. The one-two punch of rising input costs and depressed energy prices generated hundreds of billions in capital impairment.

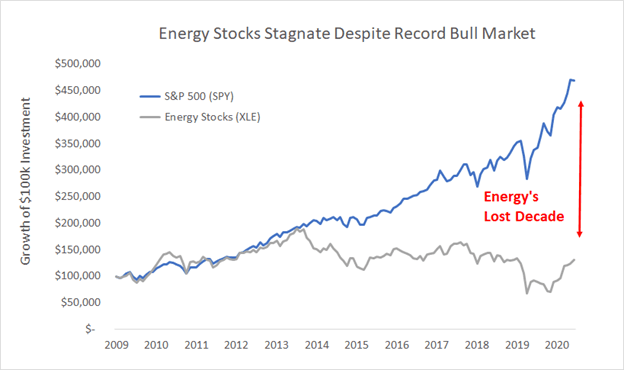

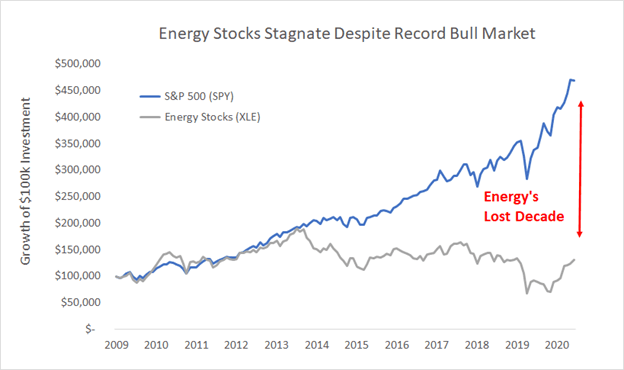

According to Bloomberg, the median internal rate of return (IRR) for private equity energy funds that started investing in 2010 is -5.6% through March 2021. Public markets haven’t fared much better. The following chart of public E&P companies versus the S&P 500 paints the picture of a painful lost decade for energy investors:

So despite a historic bull market where virtually every asset class enjoyed record returns, energy investors have generally lost money since 2010. And we’re not just talking garden variety underperformance – this lost decade included two crushing price collapses along the way, in 2016 and 2020.

The 2016 energy crash delivered a particularly painful lesson. Many tried playing the contrarian game, with tens of billions of dollars flooding into the shale patch hoping to catch a cyclical rebound. But ultimately, too many contrarians acting together turned this into a consensus play. Within 18 months of the 2016 price bottom, a flood of new drilling activity sent U.S. production surging to new record highs. This unprecedented new production growth kept prices capped at around $60, while input costs soared, killing margins and cash flow across the board.

Then of course, we all know what happened in 2020…

The Coronavirus delivered a crushing final blow to energy investors, only four years after the previous price crash. Thus, in the wake of two back-to-back oil busts and a decade of negative returns, “shale-shocked” investors are unwilling to throw good money after bad. Meanwhile, countless E&P companies themselves are pulling back from investing in new production growth. That’s because many took on excess leverage during the boom years, and must now divert cash flow towards repairing bloated balance sheets.

But these financial scars only tell part of the story driving today’s capital retreat from oil and gas development. The rest of the story relates to the rise of environmental-social-governance (ESG) investment mandates.

ESG Forces Fossil Fuel Exodus

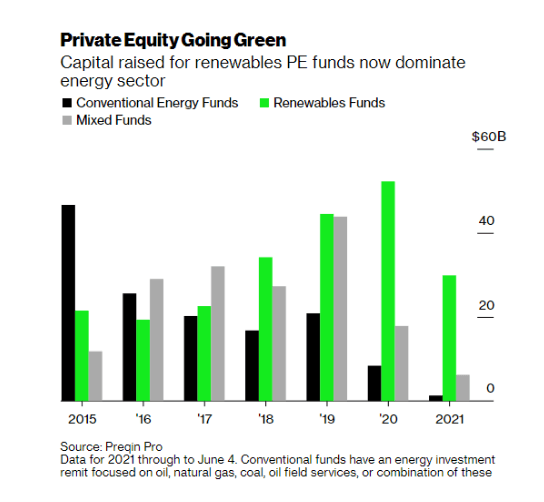

ESG investment mandates have forced a wide scale retreat away from fossil fuel development, regardless of the returns available from the industry. Kelly Deponte, a director for a private equity fund, recently explained in a Bloomberg article that private equity and pension funds are “moving away from investing in oil and gas no matter the returns in pursuit of their carbon neutral goals.”

This includes major pension funds, like the New York State Common Retirement Fund – America’s third largest public pension – which now invests capital with a “net zero” emissions target mandate. Other major capital allocators shifting away from fossil fuel development include behemoths like the California Public Employees’ Retirement System (CalPERS) and Blackstone – one of the world’s largest private equity firms.

These moves go beyond just generating headlines and talking points – it’s translating into a major shift in fund flows. The chart below shows how renewables now attract roughly 80 cents of every dollar going into energy investments, drawing vast sums of capital away from conventional fossil fuel funding:

Meanwhile, it’s just not capital allocators throwing in the towel on fossil fuels. Even the leading oil and gas companies themselves are being forced away from investments into hydrocarbon development. This includes the oil supermajors, like Chevron and Exxon – which have each come under fire from activist board members to reduce their emissions footprint. Over in Europe, the supermajors are under even greater pressure from both environmental groups and the legal system. Royal Dutch Shell recently became the first company in history ordered by a court to cut its emissions.

But here’s where the plot gets really interesting…

While the ESG movement has successfully waged a campaign to cut back on hydrocarbon supply – by attacking the investment side of the equation – they’ve yet to make any meaningful impact on the demand side of the equation.

“Peak Oil Demand” Nowhere in Sight

If we rewind the clock back to this time last year, the growing consensus narrative was calling for the “end of oil” as we know it. The headline below is one among countless examples:

The “peak oil demand” theory gained a lot of momentum last year based on the idea that COVID-19 would permanently change our way of life. One of the popular theories said that work from home would create a structural loss in gasoline demand from commuters. Fast forward to July 2021, and the American driver recently racked up a new all-time record high in gasoline consumption – using over 10 million barrels per day of gasoline over the July 4th weekend.

Meanwhile, countries like India and China show no signs of slowing their fossil fuel demand anytime soon. After all, hydrocarbons still reflect the cheapest energy source on the planet, and emerging economies need all the cheap fuel they can get.

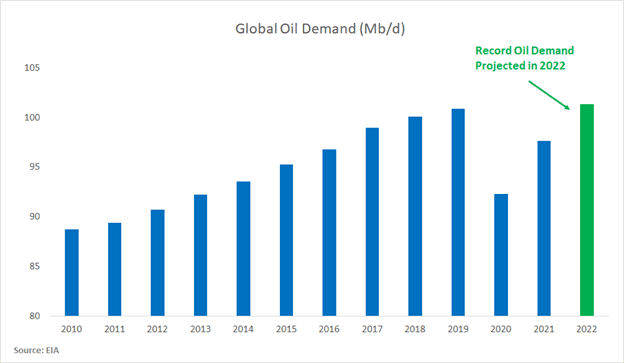

The bottom line: the end of oil demand remains nowhere in sight. Instead, we’re looking at new record highs looming on the horizon. That’s not my forecast – that comes from U.S. Energy Information Agency (EIA), which recently projected a full post-COVID recovery to new record highs in global oil demand next year:

The Opportunity Beyond the Hype

Thanks to a combination of poor historical returns and ESG-related mandates, the supply side of the oil and gas equation will likely remain impaired for years to come. Meanwhile, most analysts agree that demand will rebound towards new all-time highs in 2022 and beyond.

Thus, the stage is set for a structural imbalance between impaired supply and record demand. Not only will today’s capital retreat keep oil and gas prices elevated, but this will also help keep input costs in check, enabling the best industry margins since the dawn of the shale revolution.

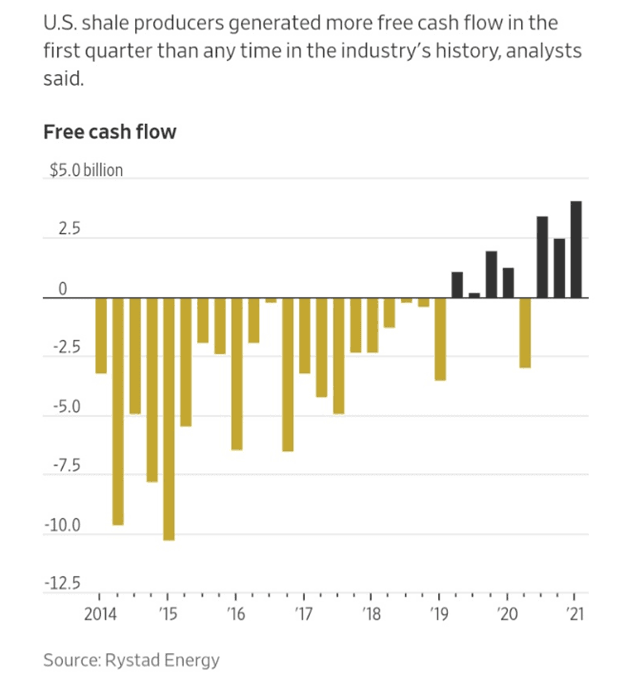

We’re already seeing this new paradigm of profitability emerge in the data. The chart below shows that U.S. shale companies are now generating more free cash flow than at any time in their history:

The bottom line: for those willing to choose facts and numbers over headline hype, we’re looking at a once-in-a-generation investment opportunity in today’s energy market.

We believe the EnergyFunders Yield Fund I provides an excellent vehicle for capitalizing on this unique opportunity. The Fund is available for investment today, and will remain open as long as capacity exists.